Unlocking financial insights with Looker: Best practices and implementation excellence

Reading Time: 6 minutes

As organizations increasingly rely on data to guide every business decision, the right business intelligence (BI) platform becomes a cornerstone for success. Among the leading tools in this space, Looker has emerged as a cloud-native solution that bridges governance, scalability, and flexibility.

Unlike desktop-first visualization tools such as Tableau or Power BI, Looker is built for the modern data stack, sitting directly on cloud warehouses to deliver governed, SQL-based analytics through a unified semantic layer. This allows enterprises to maintain consistent KPIs across teams while empowering business users with self-service capabilities.

Looker’s strength lies not just in visual storytelling but in its semantic modelling framework (LookML) that allows reusable business logic, version control, and secure embedding across products and workflows. These capabilities have positioned it as a preferred choice for enterprises that prioritize data governance, scalability, andembedded analytics.

Customizing Looker for business-centric analytics

At Sigmoid, we approach Looker implementation as an opportunity to build a modular, maintainable, and scalable analytics ecosystem tailored to each client’s needs, with a few specific customizations, including:

- Model-first architecture with LookML: A base LookML model is defined to standardize business logic, including core dimensions, measures, and naming conventions. This ensures metrics like “monthly revenue” or “customer acquisition cost” remain consistent across all dashboards and teams.

- Base-extension framework for flexibility: Extension framework is layered on top of the base model to allow business teams to override or expand measures, create domain-specific explores, and build customized dashboards. This architecture supports parallel development, enabling global updates to the base model without disrupting localized client enhancements.

- Modular and reusable components: LookML is organized into reusable files for views, measures, and domain packages. These modular components streamline onboarding, minimize duplication, and accelerate analytics delivery. This modularity ensures scalable growth as analytics needs evolve.

- Governance through CI/CD and automated testing: Each deployment follows a CI/CD pipeline with Git-based version control, automated LookML linting, and query validation. Updates and refreshes pass through staging environments with KPI-difference checks before moving to production, ensuring stability and consistency across environments.

- Embedding and APIs for seamless integration: Looker’s APIs and embedding capabilities enable product teams to deliver analytics directly within applications or expose secure data APIs. Multi-tenant dashboards and white-label analytics experiences can be configured effortlessly while maintaining access control and compliance.

Best practices for Financial Services analytics

In financial services (FS), data-driven decision-making is both a competitive advantage and a regulatory requirement. But with sensitive customer data, multiple vendor integrations, and the need for compliance, analytics platforms must balance agility with security.

At Sigmoid, we have established a set of best practices for FS analytics using Looker that ensures accuracy, governance, and business impact.

- Governance and access control: The foundation of secure analytics begins with role-based access control. In Looker, granular permissions are specified at both the model and view levels to ensure users see only what’s relevant to them. Sensitive attributes like customer IDs or account numbers are masked by default, with visibility granted only through specific access roles. This keeps PII secure while maintaining analytical flexibility.

- Dynamic data masking with user attributes: We leverage Looker’s access grants to dynamically control who can view what data. User attributes are centrally configured and mapped to access groups, enabling teams across banking, card processing, and compliance to work from the same dataset but with tailored visibility. This dynamic masking reduces data duplication and simplifies governance while preserving performance and compliance integrity.

- Unified models across financial vendors: Managing data from multiple card networks and vendors is a common challenge for financial institutions. Sigmoid’s Generic Card Processing Model in Looker integrates debit and credit network data into a single standardized framework. With meticulous data mapping and canonical field alignment, consistent analytics are enabled across attributes such as merchant, amount, and card type. This unified model lets banks track customer behavior, transaction volumes, and merchant performance in one place, scaling efficiently so each institution accesses only relevant datasets while maintaining anonymity.

Looker implementation in action

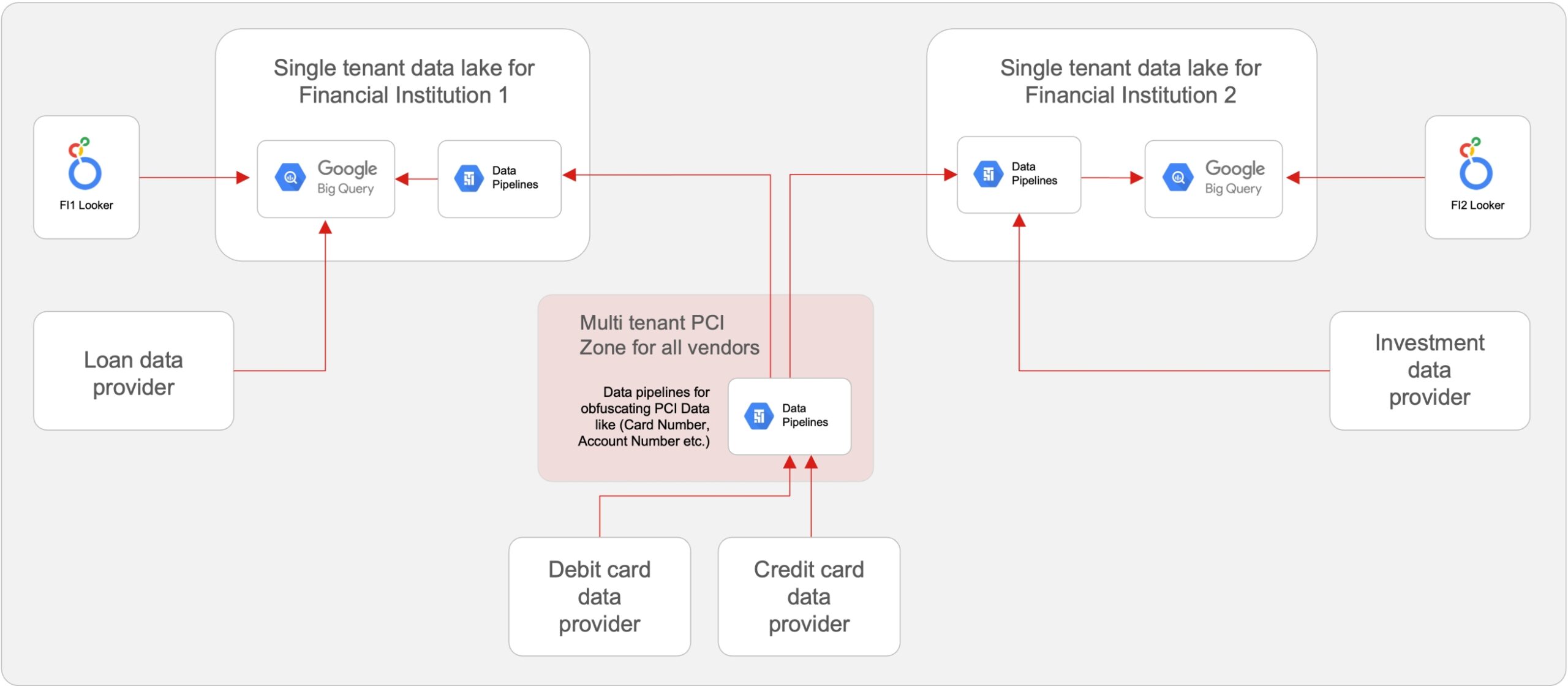

A leading global banking technology provider partnered with Sigmoid to empower its network of financial institutions (FIs) with self-service analytics. Their current multi-tenant setup limited clients’ ability to explore and modify their data independently. Each FI relied on centralized teams for new reports, leading to delays and inconsistent insights.

The challenge

The client needed a scalable, governed, and customizable analytics environment that empowers every FI client with autonomy while maintaining security and consistency.

Solution approach

We implemented a single-tenant analytics framework using Looker, tightly integrated with Google Cloud Platform (GCP) and BigQuery ML (BQML). This setup allowed each FI to build its own dashboards, extend existing models, and incorporate its datasets within a governed structure.

Key features of the implementation included:

- Predictive insights using BQML: Looker was integrated with BigQuery ML to predict subscription and transaction behaviors using logistic regression models. These models identified recurring transaction patterns and customer engagement trends, paving the way for personalized offers and the development of a “Next Best Product” recommendation engine.

- A unified banking data model: A connected DNA model, which is essentially a consolidated data layer connecting Core Banking (DNA), Digital Banking, Investments, Loan Director, and Card Processing systems was specifically designed for this case. This 360° view enabled FIs to correlate product usage, digital engagement, and member financial health in real time.

- Base–Extension architecture for self-service customization: The Base–Extension framework was introduced in Looker. The base layer standardized governance, definitions, and data logic, while extensions allowed each FI to customize models and dashboards independently. This ensured consistency across the ecosystem while fostering innovation at the edge.

- Performance optimization through Persistent Derived Tables (PDTs): To enhance performance, we used incremental PDTs that cache transformed data and refresh only incremental changes. This approach significantly reduced compute costs and query times, improving dashboard responsiveness and scalability.

Impact

The implementation delivered measurable business results, such as:

- Reduced dependency on centralized teams by enabling secure, self-service analytics for FI clients

- Improved data refresh speeds by over 40% through optimized PDTs and incremental processing

- Enabled predictive customer insights, enhancing engagement and product personalization

- Strengthened governance and compliance, ensuring role-based control and secure access for each financial institution

By transforming fragmented data systems into a unified analytics framework, the client achieved both operational efficiency and business agility that set a new benchmark for governed, scalable BI in financial services.

Fig.1. FI Looker architecture enabling consumption of vendor dashboards and self-service dashboard creation

Why Sigmoid is a trusted Looker partner

At Sigmoid, we view every Looker engagement as an opportunity to transform how organizations use data. Our approach combines engineering depth with business understanding, ensuring analytics solutions that are technically sound and strategically aligned.

| Scalable implementation frameworks | Financial domain expertise | Governed, production-grade delivery |

|---|---|---|

| Reusable LookML templates, CI/CD pipelines, and governance structures are built to accelerate rollouts while maintaining high-quality standards across environments. | Our analytics teams bring a deep understanding of financial data models, regulatory requirements, and KPI frameworks, translating complex data into actionable insights for business and compliance teams alike. | Every implementation is backed by automated testing, role-based access controls, and lineage tracking to maintain trust, auditability, and security. |

Conclusion

Looker continues to redefine how financial organizations access and act on data, moving from static reporting to real-time, governed insights that empower business users at every level.

At Sigmoid, we see Looker as more than a BI tool; it’s a foundation for decision intelligence. Our focus remains on enabling financial enterprises to innovate confidently with analytics that are secure, scalable, and built for the cloud-first future. By combining Looker’s advanced modeling capabilities with our engineering expertise, we help organizations unlock the full potential of their data by turning governance, flexibility, and speed into business growth.

About the Authors

Aarthi Guruprasad is a Senior Manager, Business Intelligence at Sigmoid. She brings over 12 years of experience in driving analytics transformation using platforms like Looker and Power BI. She specializes in designing scalable BI architectures, optimizing SQL queries for large datasets, and implementing governance frameworks to ensure data reliability. At Sigmoid, Aarthi leads Looker implementations that help enterprises modernize their analytics stack through modular data modelling, CI/CD-driven development, and impactful visual storytelling.

Harsh Kosti is an Analytics Manager, Data Science at Sigmoid with over 10 years of experience in the E-commerce, Retail, and BFSI sectors, helping businesses turn data into impactful decisions. His work focuses on designing and delivering end-to-end analytical solutions that solve real business challenges and uncover meaningful insights. He is passionate about using data to tell stories that drive strategy and growth, leveraging tools like Looker, Domo, Data Studio, BigQuery, and PLX to make information accessible, actionable, and effective.

Featured blogs

Subscribe to get latest insights

Talk to our experts

Get the best ROI with Sigmoid’s services in data engineering and AI

Featured blogs

Talk to our experts

Get the best ROI with Sigmoid’s services in data engineering and AI