Trump Cards: Turning tariffs uncertainty into competitive advantage

Reading Time: 6 minutes

Tariff uncertainty has emerged as a key disruptor, often shifting abruptly and without warning. Under the current administration, tariff levels have reached historic highs. As of early 2025, the average effective U.S. tariff rate has surged from 2.5% to an estimated 27%—the highest in over a century.¹

If there’s one shift the global economy has witnessed recently, it’s the rapid shrinking of the definition of “short-term.” Forget weeks or months—policies can now flip in a matter of days, if not hours.

Sudden and severe tariff changes carry immediate consequences. They inflate input costs, disrupt supply chains, and introduce new volatility into financial planning, sourcing decisions, and pricing strategies. In such a fluid environment, strategic decisions that once had months to mature now demand responses in days—if not hours—leaving businesses with little room for error and increasing pressure to act decisively.

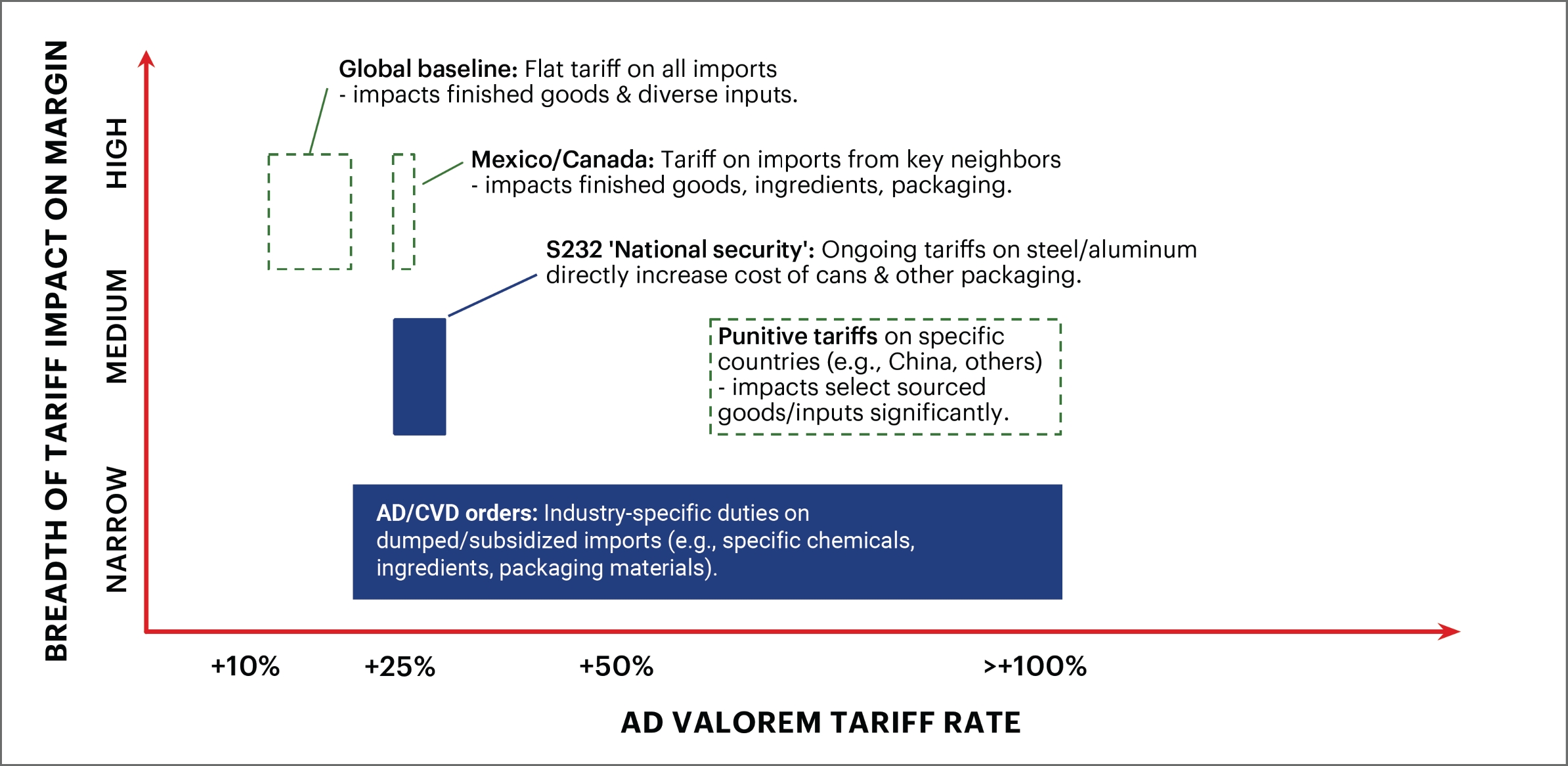

How tariff impacts your margins

Understanding tariff scenarios

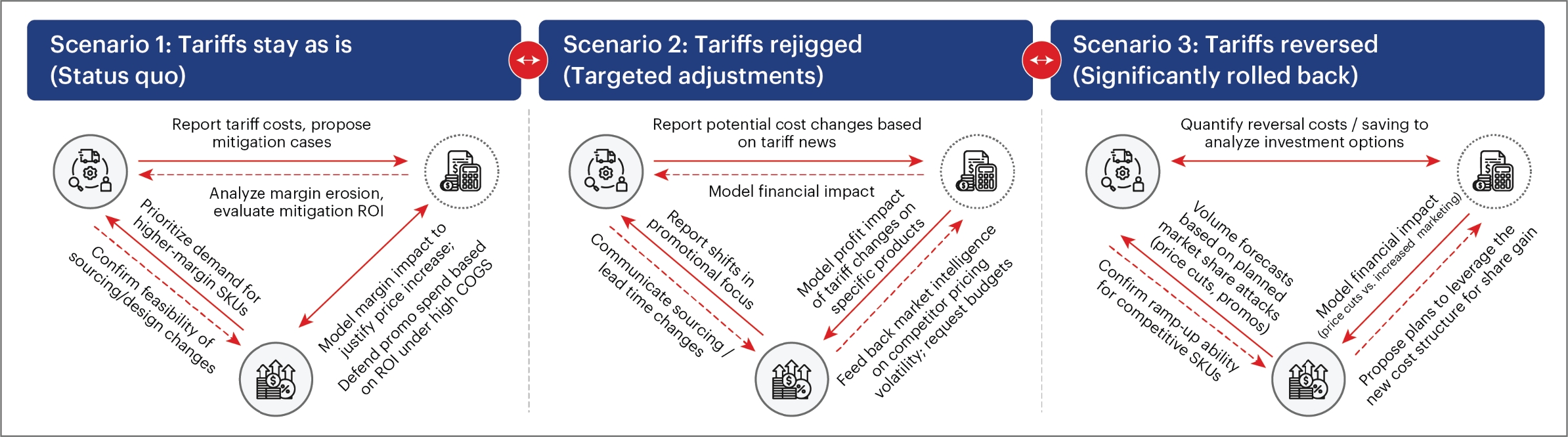

Given ongoing political volatility and potential shifts in trade policy, businesses must prepare for multiple possible futures. Scenario planning can help organizations stay ahead of uncertainty by actively modeling and preparing for three core possibilities:

- Scenario 1: Tariffs stay as-is

- Assumption: Status quo continues; exclusions may be inconsistently renewed.

- Implication: Sustained cost pressure, normalization of higher COGS (Cost of Goods Sold), and the need for permanent mitigation strategies.

- Scenario 2: Tariffs rejigged

- Assumption: Adjustments based on trade negotiations, lobbying, or geopolitical shifts.

- Implication: High agility is required and cross-functional coordination becomes key.

- Scenario 3: Tariffs reversed

- Assumption: Major policy rollback or suspension.

- Implication: Sudden import cost relief, but also margin and competitiveness shock for companies that over-invested in mitigation (e.g., nearshoring, CAPEX-heavy footprint changes).

Shared visibility to break down information silos

Responding effectively means pulling the right levers across Supply Chain, RGM, and FP&A in a coordinated way. But how do we ensure these levers work together, pulling in the same strategic direction based on the Tariff scenario?

The key lies in integrated analytics. By connecting data and insights across functions, we create a single source of truth, enabling us to see the full picture, simulate the impact of decisions before we make them, and optimize our response across the entire value chain.

Tariff response for key business functions

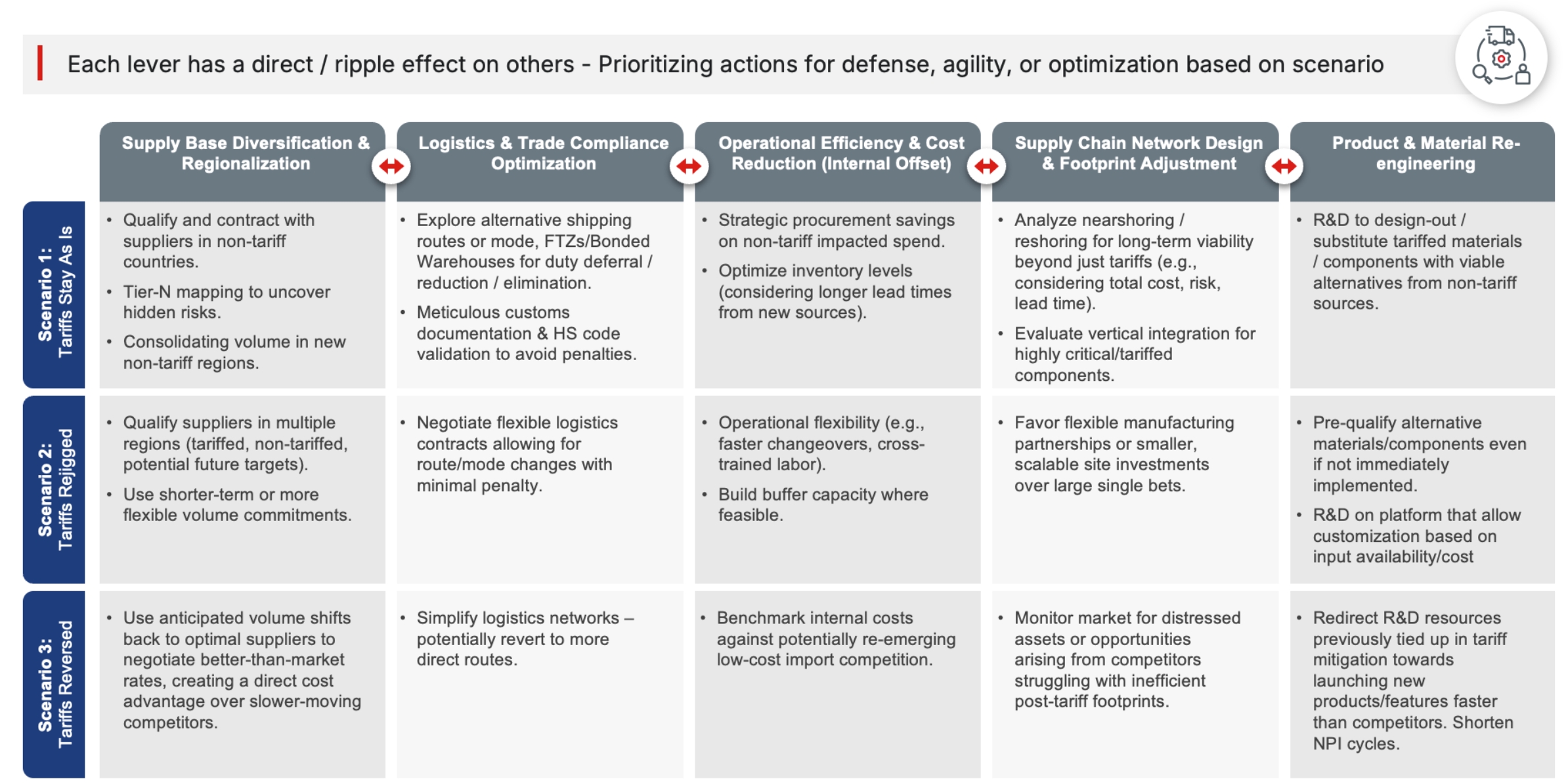

Tariff volatility impacts all business functions, whether they hold, change, or reverse. Each function must recalibrate its strategic levers to reflect the new cost and market dynamics. Supply Chain must rethink sourcing and logistics design. RGM needs to adjust pricing, promotions, and portfolio priorities. FP&A must reshape forecasts, reassess investment ROI, and safeguard cash flow.

Supply Chain

Organisations must move beyond static sourcing strategies. The new imperative is to dynamically manage the end-to-end flow of goods—balancing cost, resilience, speed, and compliance. This requires continuous evaluation of sourcing decisions, logistics optimization, potential product or material redesign. These efforts should be underpinned by robust cost modeling and risk assessments to ensure consistent and cost-effective input delivery.

Analytics support needed: Landed Cost Modeling & Simulation, Cost-to-Serve Analytics, BOM Tariff Analytics, Supplier Risk Scoring, Tier-N Visibility Mapping, Network Flow & Logistics Simulation, Trade Compliance Analytics, Make-vs-Buy / TCO Modeling, Geo-political scenario mapping, Inventory Optimization, OEE Optimization, Alternative Material Cost-Benefit Models

Revenue Growth Management

RGM sits at the crucial intersection of commercial strategy and financial reality. It plays a key role in translating volatile input costs—shared by Supply Chain and FP&A—into pricing, promotion, and portfolio strategies that safeguard both margins and market share. This demands a deep understanding of price elasticity, competitive moves, channel dynamics, and the true profitability of each product and promotion.

Analytics support needed: Price Elasticity Modeling, Competitor Price Intelligence & Tracking, Customer/Channel Profitability, Promotion ROI & Lift Analysis, Marketing Mix Modeling (MMM), Basket Analysis, Trade Spend Effectiveness & ROI, JBP Performance Tracking / Planogram Adherence, SKU Profitability & Rationalization, Margin Mix Modeling, Conjoint / MaxDiff Analysis

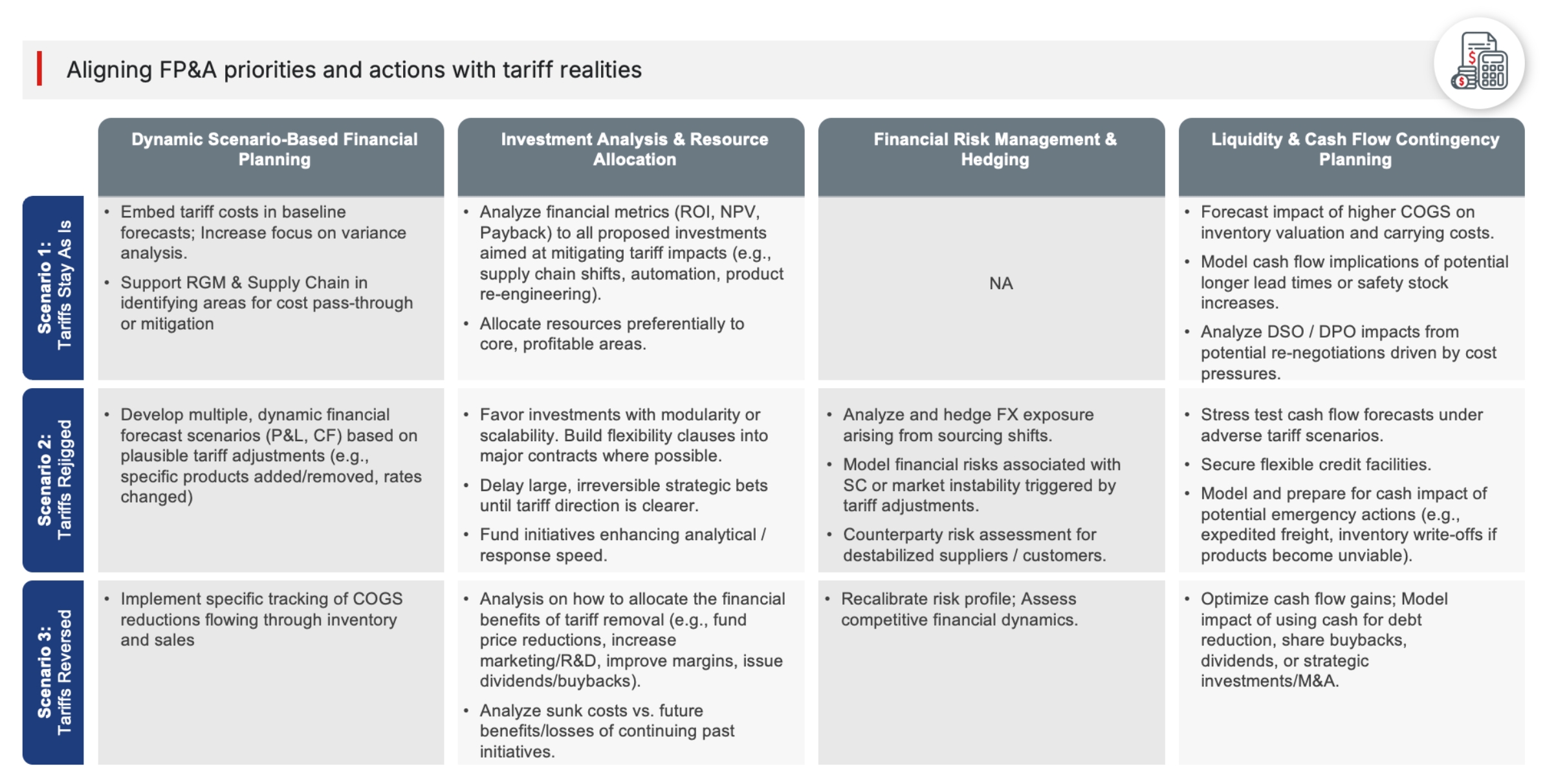

Financial planning and analysis

FP&A serves as the financial nerve center, converting operational and commercial plans into forecasts and strategic guidance. It must build robust scenario models to assess potential tariff impacts, evaluate the ROI of mitigation strategies from Supply Chain and growth initiatives from RGM, and manage cash flow pressures. Above all, FP&A ensures that capital is deployed effectively to support long-term strategic goals.

Analytics support needed: Integrated Scenario Modeling, Driver-Based Forecasting, Variance Analysis (Tariff-Specific), ROI / NPV / Payback Analyser, Real Options Analyser, Profitability Analyser, FX Exposure Analyser, Sensitivity & Stress Tester, Cash Flow Forecasting & Simulation, Working Capital Optimizer

Sigmoid’s integrated analytics solution

By planning for multiple potential tariff scenarios and aligning responses across functions, businesses can move from being reactive to proactively prepared, agile, and optimized. Sigmoid enables this shift with an integrated analytics solution that connects supply chain, revenue growth management (RGM), and FP&A through unified data pipelines and scenario-based models. This cohesive framework eliminates blind spots, enhances cross-functional coordination, and empowers leaders with a real-time view of costs, risks, and strategic tradeoffs.

This integrated approach ensures that supply chain costs directly inform RGM pricing and FP&A margin planning. RGM’s volume forecasts guide both supply chain operations and FP&A revenue projections. Meanwhile, FP&A’s financial guardrails and ROI benchmarks steer investment decisions across the enterprise. This integrated approach enhances cross-functional decision-making, enabling organizations to mitigate risk, improve forecast accuracy, protect margins, and strengthen long-term competitiveness—regardless of how the tariff landscape evolves. It empowers leaders to:

- Forecast how tariff changes ripple through the P&L.

- Align sourcing agility with pricing precision.

- Reprioritize spend and capital allocation in real time.

Conclusion

Tariff uncertainty is an opportunity for businesses to reframe how they approach decision-making. When organizations break down silos and integrate data across supply chain, pricing, and finance teams, they unlock the ability to pivot quickly and efficiently. With the right solutions, like Sigmoid’s integrated analytics, businesses can turn tariff fluctuations into a strategic advantage rather than a constant disruption. The key to success lies not in avoiding change but in anticipating it, adapting faster than competitors, and making smarter, more informed decisions that safeguard margins and drive long-term growth.

About the authors

Dattatreya Chowdhury is a strategy consultant with 8+ years of experience across e-commerce, fintech, edtech, and supply chain. Expertise in product strategy, GTM execution and GenAI-XAI based business workflow automation. Experienced in leading cross-border digital initiatives and building scalable, analytics-driven business solutions.

Anurag Bhatia leads the CPG Business-Analytics consulting practice at Sigmoid. Anurag carries over 12 years of experience spanning Consumer Goods, Retail and Manufacturing industry verticals within captive & consulting environments; working with F500 brands to deliver enterprise Digital and AI transformations.

Featured blogs

Subscribe to get latest insights

Talk to our experts

Get the best ROI with Sigmoid’s services in data engineering and AI

Featured blogs

Talk to our experts

Get the best ROI with Sigmoid’s services in data engineering and AI